How to Make Financial Decisions in Life and Business

Dec 23, 2024Introduction: How It All Went Wrong

Before I knew it, I was in financial freefall. As a mother of young children, I found myself with a terrible credit score due to small, seemingly innocent bank issues—returned payments I wasn’t even aware of. At one point, I had been earning a high income, but life took a turn: my income was slashed after my kids were born. Then came the divorce, the sale of real estate to split assets, and my bank credit line cut in half.

I was running a startup, which meant constant travel and fundraising, but living expenses didn’t pause. I covered the gaps with more loans. And then COVID hit—the business became harder to sustain, and suddenly, with no salary, the bank slashed my credit line yet again. I was leveraged to the max, sinking into an abyss.

Could this have been prevented? Absolutely. With the right financial education, decision-making processes, and mindset, I could have avoided this mess. I went on a personal mission to change how I understood money, and I want to share what I learned with you.

The Psychology of Money: Why We Make Bad Financial Decisions

Life is about relationships: relationships with people, animals, objects, and—most importantly—our relationship with money. If you’ve struggled with financial decisions, you’re not alone. People often suffer the same afflictions in their relationship with money as they do in romantic or family relationships.

The Root of Financial Behaviors: Childhood and Attachment Patterns

The way we handle money often goes back to childhood patterns. Just like attachment styles in relationships—secure, avoidant, anxious, and disorganized—we develop similar patterns with money. Understanding these patterns is the first step toward making healthier financial decisions.

|

Attachment Style |

Financial Behavior |

Examples |

|

Secure |

Balanced savings, spending, and growth |

Regularly saves, budgets, and invests wisely |

|

Anxious |

Overcompensates with hoarding or overspending |

Fear of scarcity leads to impulsive spending |

|

Avoidant |

Avoids dealing with finances altogether |

Doesn’t track expenses; ignores debt warnings |

|

Disorganized |

Inconsistent and chaotic money habits |

Swings between overspending and extreme saving |

The key to success is returning to a secure relationship with money. Security doesn’t mean playing it so safe that you stifle growth—it’s about creating a foundation that allows you to take calculated risks for progress.

As Morgan Housel, author of The Psychology of Money, says: “Financial success is not about knowledge, it’s about behavior.”

A Healthy Financial Framework: Life and Business

Let’s break it down step by step. Here’s a framework you can follow to regain control over your finances and make strong decisions.

1. Build a Strong Financial Base (Personal Finance)

Earnings and Expenses:

- Draw a box for your income and list out your monthly living expenses.

- Prioritize paying off any high-interest debt and managing loan repayments.

Steps to Build Financial Security:

- Save enough to cover 6 months of living expenses and loan repayments.

- Follow strict credit rules:

- Always pay on time to maintain or improve your credit score.

- Stay within your limits and avoid overdrafts.

- Never borrow unless you have a solid risk-adjusted plan for an increase in income.

Don’t know how to make a plan? Don’t start a business until you either learn this skill or hire a consultant who will not only do it for you but teach you how to, plan for contingencies with you and help you adjust it when new information comes in (or perhaps bring a partner who has done this in the past and doesn’t claim he knows how to build and execute a business plan - people tend to be overconfident on this one).

If you don’t do it - before you know it - you will be spending money on all kinds of things and your savings are gone without any return on your investment.

Final note on this - it’s awesome that you’re optimistic. If we weren’t over-optimistic about our abilities and how difficult it would be to start a business, no one would ever start a business! But knowing that this blind spot is that both, helps us act and become successful (there’s no success without taking a risk) and also leads to costly mistakes, disillusionment and setbacks that prevent fantastic things from being built and brought to the world, you can hedge against your own optimism-enabled incompetence by bringing pessimistic people on board who will counterbalance your lack of hindsight.

Don’t take their advice fully (most likely they will tell you to just not do it in the first place, especially if you’re a clear novice), get in the car and start driving, slowly and carefully, watching the speed limit; but ask them - if you were to do it, what’s the best way to make sure that there’s a highest payoff on the risk and if you do fail, you won’t be in a position to start your whole life from scratch. And then do what the smart advisor says.

If you’re spending more than you earn:

- Reduce spending on non-essentials.

- Find ways to increase your income, such as side projects, freelancing, or upgrading skills for higher-paying roles.

Ramit Sethi, author of I Will Teach You to Be Rich, advises: “Focus on the big wins: automation, high-yield savings, and increasing income. Don’t penny-pinch yourself to misery.”

2. Financial Planning for Business Success

Starting or running a business requires careful financial decisions to avoid the same pitfalls:

- Understand Business Expenses:

- COGS (Cost of Goods Sold), salaries, and marketing.

- Invest in learning about your industry and environment.

- Make Calculated Decisions:

- If borrowing, have a clear plan and ROI (Return on Investment).

- Borrow against base assets or use non-collateral loans responsibly.

- Budget only for test products or initiatives that lead to growth.

- Adjust for Profits:

- Use built-in human loss aversion to guide your spending habits - when you’re not spending your savings but OPM (Other People’s Money, be it investors’ or bank’s), you are forced to create revenues and profits to continue justifying the spending

- Regularly review what drives activity and profits and cut what doesn’t.

3. Rule of thumb monthly spend

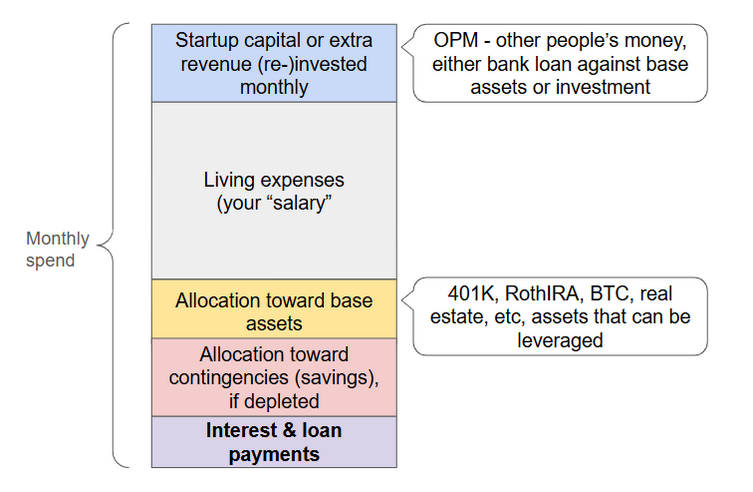

Here’s my diagram on how business spending for an entrepreneur deciding how to finance a business should look like:

The diagram above breaks down expenditures into key categories to ensure sustainable financial management.

- Living Expenses (your “salary”): At the core of monthly spending is ensuring personal expenses are covered. This includes essential costs like housing, food, and transportation. It’s critical to budget this portion carefully to avoid overspending.

- Allocation Toward Base Assets: This section highlights contributions to wealth-building tools such as 401K, Roth IRA, Bitcoin, real estate, and other assets that can be leveraged. These base assets serve as long-term financial stability tools and act as collateral when seeking additional capital or loans.

- Contingency Savings: Allocating a portion toward contingencies ensures there’s a financial cushion in case of unexpected setbacks, such as emergencies or income disruption.

- Interest and Loan Payments: Managing debt repayment is crucial to maintain a healthy credit profile and avoid compounding interest. Regular payments reduce liabilities and improve long-term financial stability.

The top layer addresses reinvestment of startup capital or extra revenue. This portion focuses on growth opportunities by reinvesting into the business or income-generating assets. Leveraging OPM (Other People’s Money), such as loans against base assets or strategic investments, can further amplify returns but should be managed cautiously to avoid over-leveraging.

In summary, this framework encourages a balanced approach: covering living expenses, growing assets, saving for contingencies, and reinvesting strategically while managing liabilities. It aligns financial security (base assets) with growth opportunities, ensuring a mix of stability and calculated risk-taking for personal or business finance.

4. Prioritize Liquidity and Stability

Liquidity is king. Before making any financial commitments, ensure you have enough liquid funds to cover:

- 6 months of both personal and business expenses.

- Existing loan repayments.

Avoid getting over-leveraged by:

- Only borrowing for opportunities that have a clear path to income generation.

- Creating financial buffers for unexpected downturns (like COVID).

Making Better Financial Decisions: Key Takeaways

- Know Your Financial Patterns: Recognize your attachment style to money and work toward a secure, balanced approach.

- Build a Safety Net: Save for emergencies, pay off debt, and prioritize liquidity.

- Invest Strategically: Make financial and business decisions based on calculated risks and clear ROI.

- Increase Income Streams: Whether through your career, side hustles, or investments, growing your income gives you options and security.

- Education is Power: Financial literacy is the key to confidence and freedom. Never stop learning.

Conclusion: From Financial Chaos to Freedom

If you’re struggling with finances—whether in life or business—know that it’s never too late to turn things around. I learned this the hard way, but you don’t have to. By understanding the psychology behind your financial decisions and building a secure foundation, you can regain control, reduce stress, and take steps toward financial freedom.

Financial success isn’t just about numbers—it’s about mindset, behavior, and a healthy relationship with money.

Start today. Take small steps, make intentional decisions, and focus on the long game.

Don't miss a beat!

New moves, motivation, and classes delivered to your inbox.

We hate SPAM. We will never sell your information, for any reason.